Navigating the Dynamic Rental Housing Market for Success

Laura February 9, 2024 Article

Navigating the Dynamic Rental Housing Market for Success

The rental housing market is ever-evolving, presenting both challenges and opportunities for tenants and landlords alike. Understanding the dynamics of this dynamic market is crucial for success in securing an ideal rental property or managing rental investments effectively.

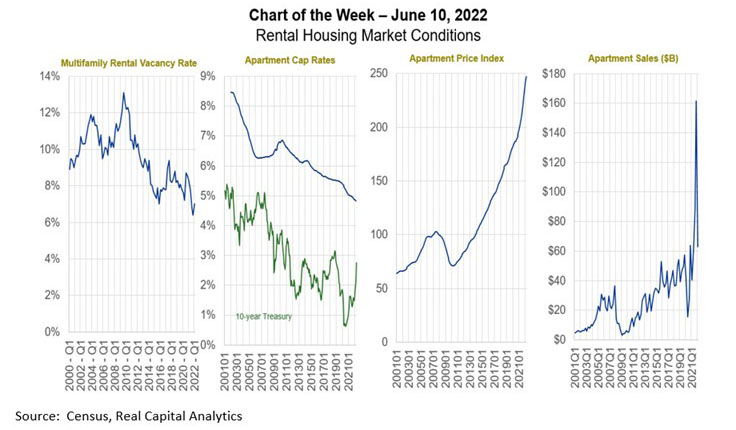

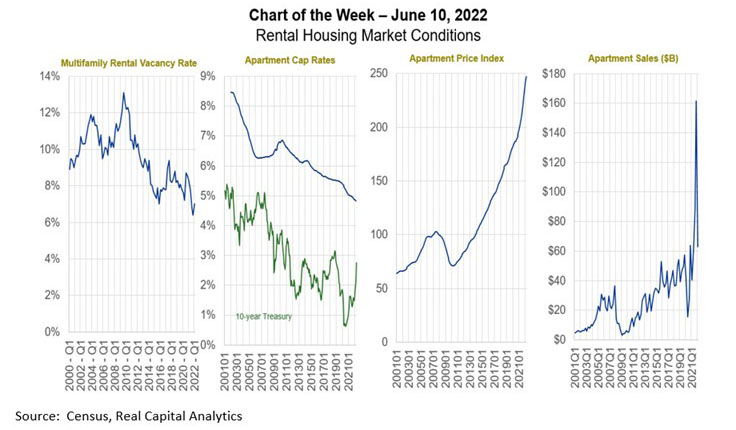

Current Trends in the Rental Housing Market

To navigate the rental housing market successfully, it’s essential to stay informed about current trends. In recent times, factors such as remote work, urban migration, and sustainability preferences have significantly influenced the demand and supply dynamics of rental properties. Being aware of these trends helps in making informed decisions.

Impact of Economic Factors on Rental Rates

Economic factors play a significant role in determining rental rates. Factors such as inflation, job market conditions, and overall economic stability influence the affordability of rental properties. Understanding these economic indicators is crucial for both tenants and landlords in negotiating fair rental terms.

Technological Advancements in Property Search

The rental housing market has witnessed a transformation in how properties are searched and leased, thanks to technological advancements. Online platforms and mobile apps have streamlined the property search process, making it more accessible and efficient for both tenants and landlords. Embracing these technologies can enhance the overall rental experience.

Urban vs. Suburban Rental Preferences

The choice between urban and suburban living has always been a critical consideration in the rental housing market. Urban areas offer proximity to amenities and job opportunities, while suburban areas provide a quieter lifestyle. Analyzing personal preferences and weighing the pros and cons of each option is vital when navigating this aspect of the market.

Government Policies and Rental Regulations

Government policies and rental regulations have a direct impact on the rental housing market. Rent control measures, eviction policies, and housing subsidies can influence the overall landscape. Staying informed about these regulations is crucial for landlords to ensure compliance and for tenants to understand their rights and protections.

The Role of Real Estate Investment in the Rental Market

Real estate investors play a pivotal role in the rental housing market. Understanding the motivations and strategies of investors can provide insights into market trends. Whether you are an investor looking for opportunities or a tenant seeking stability, recognizing the investor’s impact is key to navigating this dynamic market.

Emerging Trends in Sustainable Housing

Sustainability has become a significant consideration in the rental housing market. Tenants increasingly prioritize eco-friendly features, and landlords are incorporating sustainable practices into property management. Exploring rental options with energy-efficient appliances, green spaces, and eco-conscious designs aligns with the evolving market preferences.

Challenges and Opportunities for Property Managers

Property managers face unique challenges and opportunities in the dynamic rental housing market. Balancing the needs of tenants, complying with regulations, and maintaining the property’s condition are ongoing responsibilities. Leveraging technology for efficient property management is crucial for success in this ever-changing landscape.

The Impact of Demographic Shifts on Rental Demand

Demographic shifts, such as changes in population age and lifestyle preferences, significantly impact rental demand. Understanding the

Property Appreciation: Unlocking Value in Your Rental Investment

Laura January 31, 2024 Article

Unlocking Value: The Dynamics of Rental Property Appreciation

Investing in rental properties goes beyond immediate returns; it involves understanding the dynamics of rental property appreciation. In this article, we’ll explore the factors that contribute to the appreciation of rental properties and how investors can maximize the value of their real estate investments over time.

Understanding Rental Property Appreciation

Rental property appreciation refers to the increase in the value of a property over time. Unlike cash flow, which represents the immediate income generated by a rental property, appreciation focuses on the long-term growth in the property’s value. This appreciation can occur through various mechanisms influenced by market trends, property improvements, and economic factors.

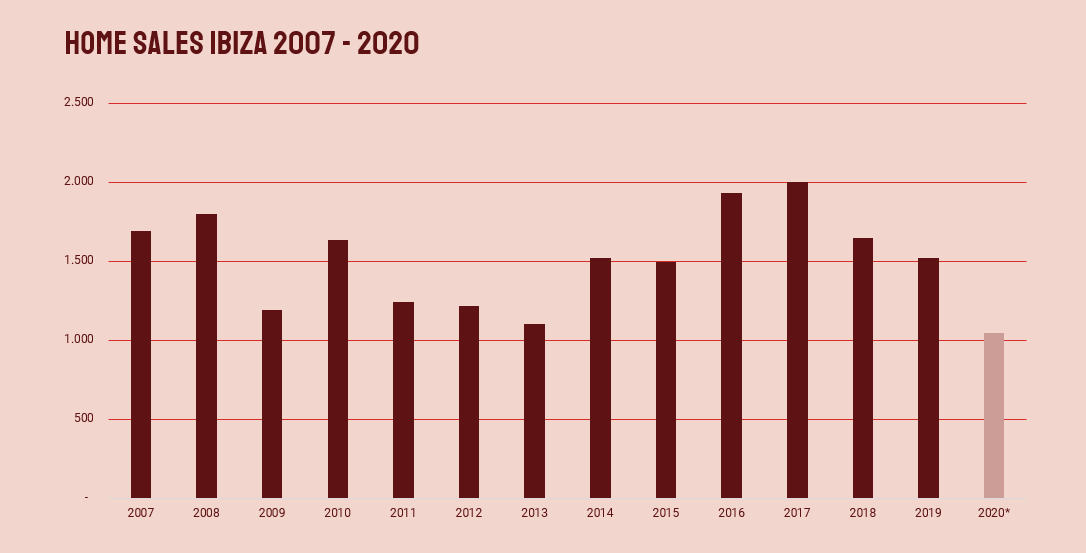

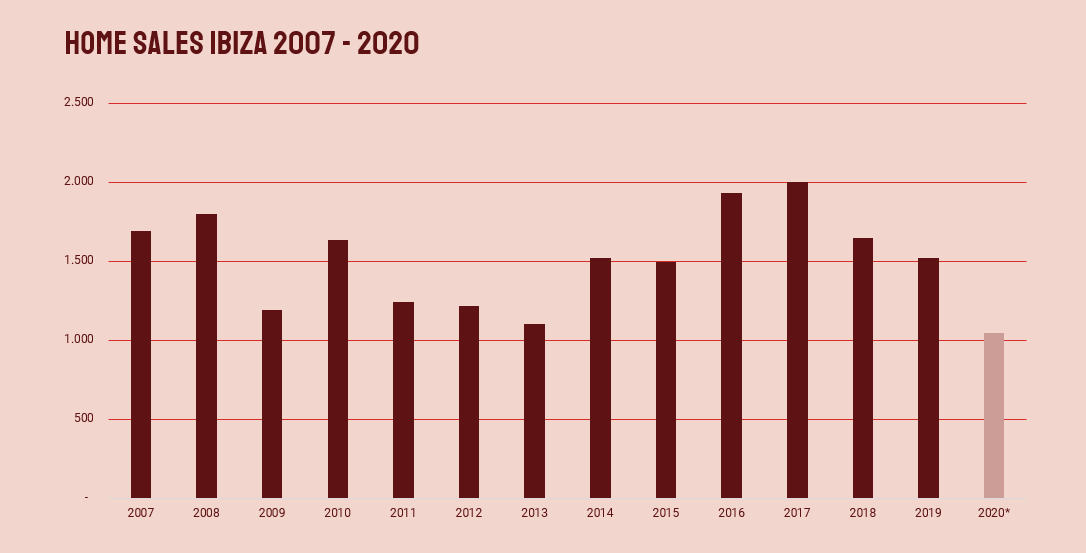

Market Trends and Location Impact

One of the primary contributors to rental property appreciation is the overall market trends and the property’s location. Properties situated in neighborhoods experiencing economic growth, urban development, or increased demand tend to appreciate more rapidly. Investors should conduct thorough market research to identify areas with the potential for positive appreciation.

Property Improvements and Renovations

The physical condition and aesthetic appeal of a rental property significantly influence its appreciation. Regular maintenance, improvements, and renovations can enhance the property’s value. This includes updating fixtures, modernizing appliances, and addressing any structural issues. Investors should strategically invest in upgrades to attract tenants and contribute to long-term appreciation.

Economic Factors and Job Growth

Economic stability and job growth in a region play a vital role in rental property appreciation. Areas with a thriving job market and economic stability tend to attract more residents, leading to increased demand for housing and higher property values. Investors should monitor economic indicators and demographic trends when selecting investment locations.

Maximizing Rental Property Appreciation

Investors can take strategic steps to maximize the appreciation of their rental properties. Regular property maintenance and improvements contribute to long-term value growth. Additionally, staying informed about local market trends and economic developments allows investors to make informed decisions that align with the potential for appreciation.

Diversification and Portfolio Management

Diversifying a real estate investment portfolio is another effective strategy for maximizing rental property appreciation. Owning properties in different locations and markets can spread risk and increase the chances of benefiting from appreciation in various areas. This approach provides investors with a more resilient and balanced portfolio.

Monitoring Market Conditions

Rental property appreciation is closely tied to market conditions, making it crucial for investors to stay vigilant. Regularly monitoring market trends, property values, and economic indicators allows investors to adjust their strategies based on evolving conditions. This proactive approach helps investors position their properties for optimal appreciation.

Long-Term Perspective and Patience

Appreciation is often a long-term play, requiring patience and a strategic long-term perspective. Investors should be prepared for market fluctuations and economic cycles, understanding that the real value of appreciation may unfold over several years. Maintaining a patient outlook allows investors to ride out market variations and capitalize on long-term gains.

Utilizing Rental Property Appreciation as a Link to Financial Growth

Investors can leverage rental property appreciation as

Maximize Returns: Investment Properties for Rent

Investing in rental properties is a strategic venture that offers both financial rewards and the potential for long-term growth. From residential homes to commercial spaces, the world of investment properties for rent provides opportunities for investors to build wealth and generate consistent income. Let’s delve into the key aspects of this lucrative market and explore how investors can maximize returns.

Diversifying Investment Portfolios: The Appeal of Rental Properties

In the realm of investment, diversification is a fundamental strategy, and rental properties offer a valuable avenue for achieving this. By incorporating real estate into an investment portfolio, investors can diversify risk and potentially enhance overall portfolio performance. Rental properties, in particular, provide a steady income stream through monthly rent payments.

Residential Rental Properties: Meeting the Demand for Homes

Residential rental properties, including single-family homes, apartments, and condominiums, cater to the fundamental need for housing. The demand for residential rentals remains robust, driven by factors such as population growth, urbanization, and lifestyle preferences. Investors can tap into this demand by strategically acquiring residential properties in desirable locations.

Commercial Rental Spaces: Catering to Business Needs

Investment properties for rent extend beyond residential spaces to include commercial properties. Offices, retail spaces, and industrial units are essential components of the commercial real estate market. Investing in commercial properties allows investors to cater to the needs of businesses, contributing to the economic landscape while reaping the benefits of stable rental income.

Location Matters: Choosing Strategic Investment Areas

The success of investment properties often hinges on location. Choosing strategic investment areas involves considering factors such as proximity to amenities, transportation hubs, and economic development. Properties located in thriving neighborhoods or emerging markets have the potential to appreciate in value and attract reliable tenants, enhancing overall investment returns.

Understanding Market Trends: Adapting to Demand

Investors in rental properties must stay attuned to market trends and adapt their strategies accordingly. Monitoring factors such as rental demand, vacancy rates, and local economic indicators helps investors make informed decisions. Being responsive to market trends allows for adjustments in rental pricing, property management strategies, and overall investment planning.

Effective Property Management: Enhancing Long-Term Returns

The success of investment properties is closely tied to effective property management. From tenant screening and lease agreements to maintenance and communication, diligent property management enhances the overall tenant experience and contributes to long-term tenant retention. Satisfied and long-term tenants, in turn, provide a stable income stream for investors.

Financing Strategies: Optimizing Investment Capital

Optimizing investment capital involves strategic financing strategies. Investors can explore various financing options, including traditional mortgages, commercial loans, or partnerships. Leveraging financing wisely allows investors to maximize the potential return on investment by using a combination of personal funds and borrowed capital.

Tax Benefits: Capitalizing on Incentives

Investing in rental properties comes with tax benefits that can significantly impact overall returns. Deductions for mortgage interest, property depreciation, and operating expenses can contribute to reduced taxable income. Investors should work with tax professionals to understand and capitalize on available

Maximizing Property Value Growth: A Strategic Investment Approach

Investing in real estate is not just about owning property; it’s about strategically maximizing property value growth. In this article, we’ll explore the key factors that contribute to property value growth and how investors can adopt a strategic approach to elevate their investments over time.

Understanding Property Value Growth

Property value growth is the increase in the monetary worth of a property over time. This growth is influenced by various factors, both external and internal, and understanding these dynamics is essential for investors looking to capitalize on the long-term appreciation of their real estate assets.

Market Trends and Location Dynamics

One of the primary drivers of property value growth is the overall market trends and the property’s location. Real estate situated in areas experiencing economic development, population growth, and increased demand tends to witness higher appreciation. Investors should conduct thorough market research to identify locations with promising potential for property value growth.

Strategic Property Improvements

Investors can actively contribute to property value growth by strategically improving their assets. Regular maintenance, renovations, and upgrades enhance the property’s appeal and functionality, making it more attractive to potential buyers or tenants. A well-maintained property not only retains its value but also has the potential for increased appreciation.

Economic Stability and Development

Economic stability in a region is a key factor influencing property value growth. Areas with a strong and growing economy tend to attract more residents and businesses, leading to increased demand for real estate. Investors should keep a close eye on economic indicators and development plans when considering properties for long-term value growth.

Leveraging Market Appreciation

Market appreciation, driven by supply and demand dynamics, plays a crucial role in property value growth. Investors can leverage market trends by purchasing properties in areas with anticipated appreciation and holding onto them for the long term. This strategic approach aligns with the natural progression of property values in high-demand markets.

Investment in Infrastructure and Amenities

Local infrastructure developments and amenities can significantly impact property value growth. Proximity to public transportation, educational institutions, parks, and shopping centers can enhance a property’s desirability and contribute to its appreciation. Investors should consider these factors when evaluating potential investment opportunities.

Optimizing Rental Income

For investors considering rental properties, optimizing rental income can indirectly contribute to property value growth. Increasing rental income through strategic pricing, property enhancements, and attracting long-term tenants positively influences the property’s overall value. This dual benefit of rental income and potential appreciation enhances the investment’s overall return.

Adopting a Long-Term Investment Strategy

Maximizing property value growth often requires a long-term investment perspective. Investors should be patient, understanding that property appreciation may unfold over several years. Adopting a strategic, long-term approach allows investors to weather market fluctuations and benefit from the compounding effect of value growth.

Diversification and Risk Management

Diversifying a real estate investment portfolio is a risk management strategy that supports property value growth. By owning properties in different locations and markets, investors spread risk and increase

For A Comprehensive Collection Of Tips About Real Estate Investing, Read This

Laura November 4, 2022 ArticleMany people have had great success with investing in real estate. The reason for this is mainly because they all have in common is proper research. This article will share some great information to help you do the same. Read them and you will have a great starting point.

There are to essential rules to making an investment in an industrial or commercial real estate market. You don’t want to pay too much for the square footage. Do not pay too much money on the business itself. You need to be sure both numbers if the property is something you’re interested in.

Get to know others in real estate. It’s important to reach out to others and to hear what kinds of advice from those more experienced than you. It can be helpful to have a couple of friends who know about investing in real estate. You can easily find like-minded people by looking online.Join a few forums and make an effort to meet some of the users.

Problems with tenants may consume a lot of time for you.

Take the neighborhood into consideration before investing. Neighborhoods that are highly sought after will bring you value for many years to come, while depressed areas might cost you money or yield a lower return. Location is always be the key determinant for a property’s value.

Hire a reliable property manager who can screen tenants.Since the rent they pay will pay your mortgage, you want to know they can keep up with your payments.

Location can make a huge difference in the earnings potential of real estate investment. Think about the location and how it might be in the possible potential.

Don’t make a purchase just to increase the sake of owning more properties. Investigate thoroughly before you invest and remember quality over quantity. This will help ensure you to succeed in the long run.

Try working well with other people.This is a great way to share resources and resources. You can have many satisfied clients through networking and amicable relationships. This will also help build your reputation.

Do your research prior to investing in. There is usually a website created for a particular city. You can discover city planning details and other info that might impact real estate values in the future. A city in growth mode can be a good investment.

Subscribe to a foreclosure listing service that provides you will deals as soon as they become available. This service saves you a lot of time and effort. These are likely to be current so that you can get accurate and up-to-date.

The next step you take if your first towards real estate investment success and this article will help with just that. Giving it a random go isn’t going to work out, so you must dedicate yourself to the venture and utilize the tips discussed. You’ll be happy you did when you see it all paying off!

Have you always longed to get into real estate investments but didn’t know how to get started? You might have seen some shows that involved flipping houses and the amount of money they can make. Continue ahead for more tips!

Once you make the decision to invest in real estate, you should set up either an LLC or a similar entity. This will protect both you and the investments that you may make. There are possible tax benefits concerning the business as well.

You need to decide the type of investments you want to invest in prior to beginning your first property. You might be a good fit for real estate flipping is just your style.

Always get a good feel of the local values are like. Finding out the average rental rates and whether they rent or own can tell you more about a home’s value than the financial statements.

Don’t invest in property that has not been personally inspected by a third-party or realtor. Sellers who pony up their own inspector may use professionals that are biased towards them. You need neutral inspections or reports from a professional you can trust.

Real Estate

Get to know others in real estate. It’s important to reach out to others and get advice from those more experienced than you. It can be useful to have a couple of friends who know a lot about investing in real estate. You can find a community of investors on the Internet. Join a few forums and make an effort to meet some of the users.

This will give you with helpful information for you to start using in your own investment strategy. You might even sometimes have conversations with some of these people.

Don’t invest a huge amount of money in real estate without researching the research first. Errors in this field can generate some major losses if you don’t watch out.

Take the neighborhood before investing in property there. Neighborhoods where people want to live tend to hold or even rise in value over time, and neighborhoods that are depressed won’t pay off so well. Location is always be the key determinant for a property’s value.

Have some idea what your time is worth. You might love rehabbing a property yourself, however is the amount of labor required worth your time? Or perhaps your time is better off searching for another great investment opportunity. It’s okay to make time for more important parts of the business.

Getting involved with real estate investing is a powerful tool to help you succeed with your money. You are the secret to your own success when you learn how to and actually do choose the best properties. Remember these great tips and begin your real estate investment program soon.

Discussing Real Estate Investing, Read This Article To Learn It All

Laura October 24, 2022 ArticleReal estate can be a great investment opportunity. You have a lot of control over who you want to rent to.Keep reading to learn how you can make smart real estate investment tips.

Always try to find out what the local values.Finding out the neighbors are and whether they rent or own can provide an idea of the neighborhood.

Legal Fees

Do not forget about other costs that increase the amount you have to spend on a property. You need to pay staging costs, legal fees, legal fees, and quite a few other things that can make your bottom line more. Consider all costs when you work on your margins.

There are two things to take into consideration when entering the industrial or commercial real estate market. You don’t want to make sure that you get a fair deal on the square footage. Do not spend too much money on the business itself. Each of these numbers should be good.

Location is essential when investing in the key to any real estate investment. Property conditions and other factors are usually subject to change. Properties that are in depreciating areas aren’t going to turn out well for you. Know what you are doing and make sure to research the areas around where you’re buying property.

Get to know others in your local real estate market. It’s important to reach out to others and to hear what kinds of advice they can give you if they are more experienced than you. It can be helpful to have friends that know a lot about real estate. You can find some online. Join some forums and look into attending meetups.

Be certain to choose regions that are in a well-known area in which potential tenants might be interested. This is something that’s important because it will help the property. Try looking for properties that can easily be maintained.

Understand that time is valuable. You could love rehabbing, you should consider if the time spent doing manual labor is worth it. Or perhaps your time is better suited to looking for the next great opportunity? It’s okay to make time for focusing on other important aspects of the business you have.

It may even be illegal to dig before checking for lines, and it pays to find this out up front.

Don’t buy your real estate in bad areas. Pay close attention to where a property is located.Do all of your homework before you make a decision.A great deal on a beautiful house may mean it is in a bad area. It might be difficult to sell and hard to sell.

Real Estate

If real estate investing is serious to you, this was a great start. You must consider every option, and choose the one that fits what you need. You will make much greater interest with real estate investments than with a bank account. This will result in more money for you in the future.

Many people want to flip houses as a way to earn a good living.This is an excellent way to turn a lot of profit over time. Look into your real estate options with the tips ahead and begin to learn all you can.

Do proper research before real estate investment. Check around 100 properties, and take notes in a spreadsheet. Things to list include current pricing, projected rent earnings, and current prices. This will allow you sort the good deals to sort good from bad.

Always try to find out what the local values.Mortgages and rent costs will give you to feel how much a good idea your property value.

Real Estate

Find other people involved in this business and learn everything you can from them. There are lots of people out there that want to get into investing in real estate. There are probably many groups focusing solely on real estate investing. If you can’t find anything like this where you live, consider checking online for forums. Get out there and learn from your peers can teach you.

Do not forget about other costs that increase the amount you have to spend on a real estate investment property. You have closing costs, closing costs, staging costs, along with many other potential expenses that will impact your bottom line. Consider all costs when determining your margin.

There are a couple of things to consider when entering the industrial or commercial real estate market. You want to pay too much for the square footage. Do not pay too much money on the business itself. You must settle on good numbers in order for you to make the property is something you’re interested in.

Problems with tenants can waste a great deal of time.

Be certain to choose regions that are in a well-known area in which potential tenants might be interested. This is important because it could give you the best amount of resale when you make your purchase. Try looking for properties that you can easily be maintained.

Don’t assume that you aren’t guaranteed to make a profit; property values always rise. This assumption is risky in this market and any one piece of property. Your safest bet is to only invest in things that give you a positive cash flow. Property value increases will definitely be good for your income and profits.

You might be surprised to know that people sometimes don’t do all the work for you just by letting them speak. If you listen closely, you may be able to get a reasonable price.

Allow yourself to become excited about investing in real estate vs feeling intimidated. So many things can happen in the world of real estate, whether it’s buying houses or renting out properties. Stay updated on the latest information, and you are sure to succeed. Keep the suggestions here close at hand to ensure the best return on your investment.

This Is The Most Comprehensive List Of Tips Regarding Real Estate Investing You’ll Find

Laura October 13, 2022 ArticleDoes being the next big real estate mogul? Well, it can be exciting, it requires a good bit of strategic planning. This article discusses helpful real estate investment tips for making great gains and avoiding major pitfalls.

Your reputation is essential to the success of utmost importance when you venture into real estate investments.This makes you credible and ensures loyalty from clients.

Never invest in a property that you have not had inspected by an independent or third-party professional. Sellers may be using someone who will favor them.You need neutral inspections or reports from a professional you can trust.

This is going to give you with valuable insight that will help you to formulate your own strategies. You can even have conversations with someone on a personal basis.

Be patient when beginning.It could be a longer time than you anticipated for your first deal in real estate to present itself. Don’t get anxious and make less than perfect investments. That is a wise use of your money.Wait until a great investment comes along.

Learn about the neighborhood and surrounding areas before investing in real estate. Location is everything in terms of prices and zoning laws you need to know about. Talk to the neighbors and try to get a better feel of if it will be worth it.

Location is paramount when considering a real estate investment. Think about the location and how it might be in the future.

This will minimize risk since you’ll already have a good feeling for the neighborhood already.You will live near your rental property so you won’t need to think about what’s happening in the neighborhood as much since you’ll be close to it. You will have better control of this investment if you live nearby.

Try working well with other people.This allows you to share both client lists and combine all your knowledge to get a better deal on different properties. You can find a lot of potential and eventually satisfied clients if you help one another.This will also help improve your reputation.

Make sure that you put some accounting skills to use.You can easily overlook doing this, particularly in the beginning. There is a ton of other things you will need to consider when investing in real estate. It is vital that you have good bookkeeping practices.You will surely save yourself to avoid a lot of problems later if you have solid bookkeeping now.

Do your homework about municipal governments of any real estate market you are considering investing in. There should an official website that is officially created for the city. You may discover city planning that will influence your decisions. A city would be a smart place to invest.

Real Estate

Hopefully, you have learned some great tips on investing in real estate. Real estate is a risky business, but you are now prepared to mitigate risks and focus on profit-making. Do it wisely, and you can make a ton of cash.

Many individuals have made impressive sums of money by investing in real estate investing. However, if you aren’t completely familiar with real estate investing, it can be tough to make any headway. The information below can help you in real estate investing.

Do proper research before real estate investment. Look at between 50 and 100 properties in a location you desire, and keep a spreadsheet full of notes.You need to be looking at how much you’ll make in rent, rental potential, and how much the current prices are. This will allow you weed out the bad from the good.

Always try to find out what the local values.Finding out the average rental rates and mortgage values in a particular area can tell you more about a home’s value than the neighborhood.

Dedicate a set quantity of your time to learning about and making real estate investments. You might have to curtail your time spent on other activities in order to make good profits consistently. Ditch the poker night or softball league that you have more time to hone your investing skills.

Find your comfort zone and work within it. You can successful invest if you stay focused within your market segment. Whether you specialize in flipping homes, only working with starters, or dealing in properties that cost low in the down payment department, stick with what you are familiar with if you want to see success.

Legal Fees

Do not forget about other costs that increase the amount you have to spend on a real estate investment property. You may have to pay closing costs, legal fees, legal fees, and quite a few other things that can make your bottom line more. Consider all costs when you work on your margin.

Get to know other people who invest in your local real estate. It’s important to reach out to others and get advice they can give you if they are more experienced than yourself. A few friends knowledgeable about real estate can be handy. You can easily find like-minded people by looking online.Join a few forums and make an effort to meet some of the users.

This will help to insure that you are starting out correctly with your investments. There is nothing worse than paying out of your own accounts due to the rent not covering the mortgage.

If you are thinking of renting out your investment property, be wary of the person you allow to rent it. The person will need to be able to pay both the first months rent and a deposit. If this isn’t possible with the tenant, they may fall behind the rent. Keep on looking for the right tenant.

You must know how to spend your time doing. You may enjoy rehabilitating properties, but is your time worth the manual labor work? Or is it better suited to looking for another great investment opportunity. It’s worth it to free some time for more important parts of the business you have.

Real Estate

The …

- Total visitors : 2,828

- Total page views: 3,063

Recent Posts

- Ransomware Recovery: Navigating the Path to Restoration

- Handyman Furnace Repair

- Kelly Wearstler Lighting

- How to find best housekeeping companies in dubai

- Embracing Modern Home Decor

- Why are welding workshops and welding inspections crucial?

- Comprehensive Overview of Data Recovery Services

- Rumah Pintar untuk Masa Depan

- Tips Membeli Rumah untuk Calon Pembeli

- Choosing the Right Location

- The Ultimate Home Bar Setup

- Unveiling Your Dream Home: A Guide to Buying Property in Abu Dhabi

- Transform Your Garden DIY Pond Waterfall Inspirations

- Personalized Outdoor Spaces DIY Seating Inspirations

- Blooming Beauties Creative Flower Beds Around House

- Farmhouse Kitchen Design Rustic Charm for Modern Living

- French Chic Living Room Décor Ideas for Elegant Interiors

- Transforming Spaces Complete Home Renovation Guide

- Budget-Friendly Garden Beautification Dollar Tree Finds

- Whimsical Wonderland Adorable Bedroom Decor for Dreamers

- Transform Your Outdoor Oasis with DIY Patio Projects

- Budgeting Basics Complete Renovation Cost Breakdown

- Inviting Front Garden Ideas for Welcoming Home Entrances

- Skilled Fixer Upper Contractors Transform Your Space Today

- Elegant Dining Formal Dining Room Decor Inspiration

- Transform Your Family Room into a Relaxation Haven

- Personalize Your Walkway Creative DIY Stepping Stones

- Rustic Charm Country Home Decor Ideas & Inspiration

- Elegance Defined Formal Living Room Ideas for Your Home

- Transform Your Outdoor Space DIY Backyard Landscaping Ideas

Categories

- About

- Business

- Business Checks

- Business Checks

- Business Ideas

- Business Ideas

- Business Insider

- Business Insider

- Business Letter

- Business Letter

- Business Line

- Business Line

- Business News

- Business News

- Business News Articles

- Business News Articles

- Business Owner

- Business Owner

- Business Plan

- Business Plan

- Business Website

- Business Website

- Business Week

- Business Week

- Economic News

- Economic News

- Finance

- Financial News

- Financial News

- General Article

- Google My Business

- Google My Business

- Income

- Money

- Online

- Online Business

- Online Business

- Opportunity

- Opportunity

- Profit

- Profitability

- Real Estate

- Small Business

- Small Business

- Small Business Ideas

- Small Business Ideas

- Starting A Business

- Starting A Business

- The Business

- The Business

- Uncategorized

Archives

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

Partner

ecommerce web design dubai

ecommerce website development dubai

ecommerce website dubai

ecommerce development in dubai

ecommerce development company dubai

ecommerce development company in dubai

ecommerce development dubai

ecommerce website development companies in dubai

ecommerce website development company in dubai

ecommerce website development in dubai

ecommerce website design company near me

ecommerce website design company dubai

ecommerce web development dubai

web ecommerce development

ecommerce website in uae

ecommerce website design dubai

ecommerce web design agency

Partner

app design Dubai

app developers in dubai

app development companies in dubai

app development dubai

application development dubai

app developers uae

app development companies in uae

app development uae

mobile App designer Dubai

mobile App Development Company Dubai

mobile app development company in dubai

mobile app development dubai

mobile application dubai

mobile app development company in uae

mobile app development uae

mobile application development uae

mobile app development company